The Shard Perspective: what clarity looks like for FMCG suppliers in 2026

Last week, I had the pleasure of presenting at The Grocer Commercial Business Lunch, hosted in one of London’s most iconic settings: The Shard.

Aside from the excellent company and conversation, the venue itself sparked a useful thought. When you’re 72 floors up, you get complete oversight of everything below. Patterns emerge on ground level and it’s often easier to see what really matters.

That idea of perspective became the backbone of our session at the event. Rather than revisiting familiar debates around regulation or enforcement, we wanted to step back and talk about what suppliers are actually seeing as they plan for 2026 — and where clarity is still missing.

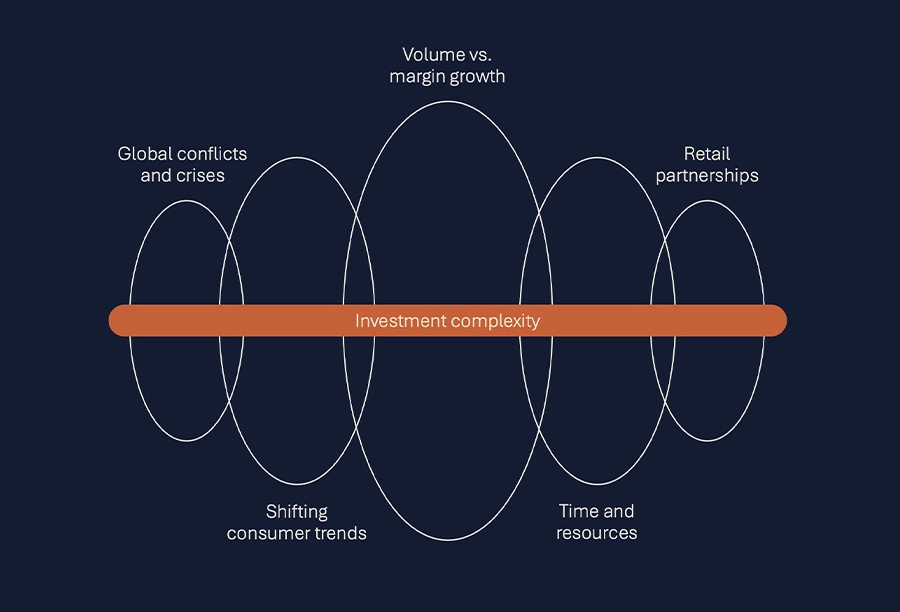

The pressures suppliers are carrying into 2026

Some of the challenges discussed on the day didn’t come as a surprise. Global instability, cost inflation, and shifting consumer behaviour are common themes.

We wanted to look deeper, though, such as the ongoing tension between volume and margin. One conversation that stuck with me came from a CFO we’d planned to have on stage — a senior leader in a major FMCG business — who couldn’t attend at the last minute but had been keen to talk about “partners for growth”. Not as a slogan, but as a necessity in what she described as “tough trading conditions, with very little margin for error”.

That phrase — margin for error — came up repeatedly throughout the day.

Why clarity matters more than ever

Much of the discussion centred on data, insight and technology. How suppliers are trying to use better forecasting, better analytics and better consumer insight to make smarter investment decisions.

From Salitix’s perspective, we offer a unique benefit in that ecosystem. Our work is inherently retrospective — we look at what’s already happened — but the value isn’t just in recovery. It’s in the clarity that comes from reconciling intention with reality.

When suppliers understand where promotions underperformed, where pricing didn’t flow through as expected, or where deductions were simply wrong, they’re better placed to make decisions prospectively. That, in my view, is a critical — and often overlooked — part of being a credible partner for growth.

Profit isn’t just about selling more

When people talk about profit in FMCG, the conversation usually turns to sourcing efficiencies, manufacturing optimisation, scale, or M&A. All valid levers.

But one of the points I made during the session is that profit recovery sits in a different category altogether. The money recovered through reconciliation isn’t hypothetical. It isn’t dependent on future volume. It’s net — and it drops straight to the bottom line.

Recovering £50,000 through reconciliation is not the same as generating £50,000 in incremental sales. There’s no additional cost of goods, no promotional funding attached, no pressure on sales teams. In an environment where top-line growth is hard won, that distinction matters.

Why internal teams can’t always see it

A fair question raised during the discussion was why this work can’t simply be done in-house.

The honest answer is complexity. Suppliers trade with multiple retailers, each with different systems, processes, legacy data and funding mechanisms. The cost and effort required to reconcile those environments at scale is significant — which is why historically, very little sales-side auditing has taken place compared to retailer-led audits.

We’re also not a technology-only solution. While AI and automation have a role to play, much of what we do relies on experienced auditors applying context, judgement and commercial understanding to thousands of transactions. That human layer remains essential in a trading environment that is still relational, nuanced and — at times — imperfect.

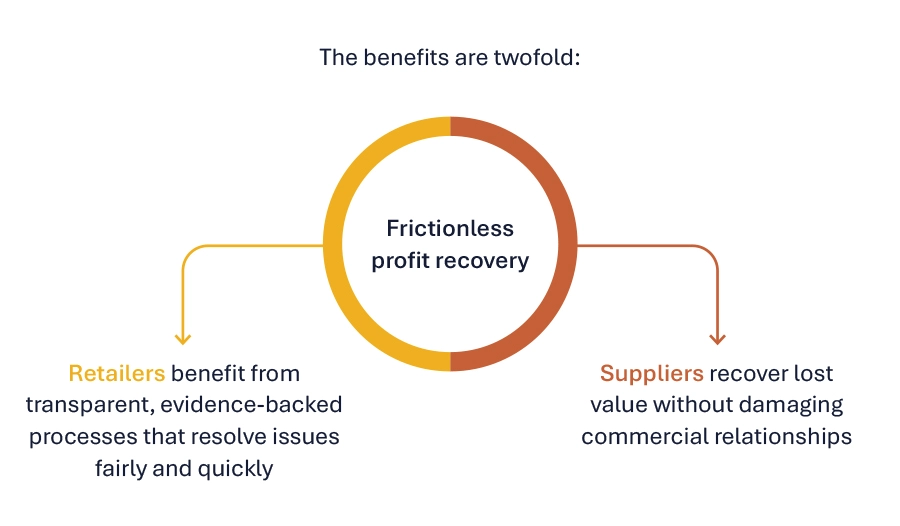

Why “frictionless” really matters

One of the most important themes we discussed was friction.

Historically, profit recovery has been associated with confrontation, escalation, or damaged relationships. That’s precisely what frictionless profit recovery is designed to avoid.

By operating through audit and finance channels, separate from day-to-day commercial discussions, issues can be resolved quietly, based on evidence, and without destabilising trading relationships. In many cases, relatively small discrepancies are corrected without ever becoming “an issue” in the commercial sense.

That separation isn’t accidental. It’s rooted in best-practice principles that retailers themselves have signed up to — and it’s the reason recoveries today look very different to those of a decade ago.

A clearer view from above

If there was one takeaway from The Shard Perspective, it was this: clarity is becoming a competitive advantage.

Suppliers don’t want conflict. Retailers don’t want disruption. What both sides need is accuracy, and confidence that small errors won’t quietly compound into bigger problems.

Looking ahead to 2026, releasing money you didn’t know you were owed might not sound transformational. But in a low-growth, high-pressure environment, a series of £10k, £50k or £100k recoveries can be the difference between standing still and investing forward.

Sometimes, all it takes is a higher vantage point to see what’s been hiding in plain sight.

Speak to us to see how we could help you uncover hidden profits and help you overcome your biggest challenges in 2026.